Anything can happen in an auto business, whether a sudden equipment breakdown or an unexpected customer complaint. While you’re focused on delivering top-tier service, it’s just as important to protect your shop, team, and customers from the unknown.

That’s where the right auto repair shop insurance comes in. It’s an effective safety net that shields your business from potential risks. From covering property damage to handling liability claims, a comprehensive policy can give you peace of mind and financial security.

In this guide, we’ll walk you through the must-have types of auto shop insurance and share practical tips on choosing coverage for your car repair business.

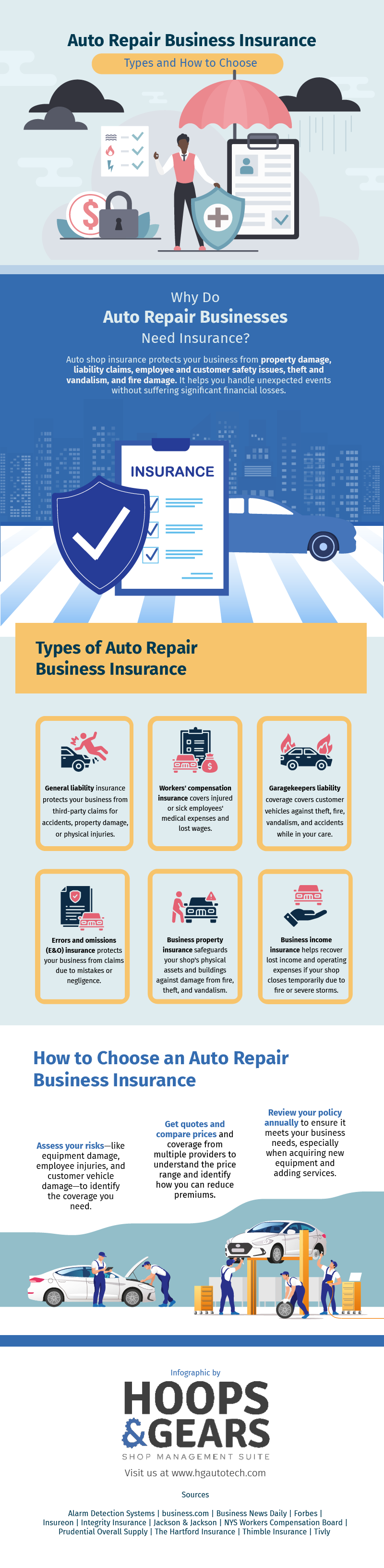

Why Do Auto Repair Businesses Need Insurance?

Running an auto repair shop comes with literally many moving parts. You must manage expensive tools and equipment, cars, staff, and customers well. All that responsibility comes with various risks. Here’s how an automotive shop insurance can protect you.

- Property damage

Whether it’s a fire, storm, or vandalism, anything can damage your shop’s equipment and customer’s vehicles. Property insurance protects your assets from a huge financial hit when things go wrong. - Liability claims

Mistakes happen—maybe a customer’s car gets damaged in your care, or a repair didn’t go as planned. General liability insurance protects you from lawsuits by covering legal fees and other damages that might arise. - Employee and customer safety

Accidents are inevitable in a busy garage. An employee may get injured when repairing a car, or a customer might slip inside your shop. Insurance like worker’s compensation and general liability can cover medical costs and protect your business from costly claims.

- Theft and vandalism

Auto repair shops are prime targets of theft due to the valuable parts and equipment they have. Sometimes, trespassers may go after customers’ belongings. You may also experience internal theft, where employees make negligent repairs or steal equipment, wages, and even cars.

With theft and vandalism insurance, you’ll be covered if someone steals from your shop or causes damage. - Fire damage

With the mix of vehicles, tools, and potentially flammable materials, fire is a real concern in any repair shop. Fire insurance protects your building and inventory if the unexpected happens.

Types of Auto Repair Business Insurance

Different policies cover various risks, so it’s essential to understand what they do and how they can protect your business. Here are the most important types of automotive repair shop insurance and why you might need them.

1. General liability insurance

This insurance protects your business from third-party claims involving accidents, property damage, or bodily injury. Suppose a customer or delivery person slips and falls at your shop and decides to sue. General liability insurance can cover medical expenses, attorney fees, and court-ordered judgments.

This policy also covers you if your shop inadvertently damages a customer’s vehicle or property while in your care. Plus, it offers protection against advertising injuries, like defamation (both libel and slander) and accidentally using someone else’s logo or slogan in your marketing efforts.

2. Garagekeepers liability coverage

Also known as storage location insurance in some states, this policy protects customers’ vehicles that you service. It covers damage like theft, fire, vandalism, and accidents.

For example, if an employee accidentally backs into a customer’s car or if a vehicle is vandalized in your lot, garagekeepers insurance will cover the repair costs.

This policy offers the following coverage options:

- Legal liability covers damage you or your employees cause, such as a cracked windshield during maintenance.

- Per-occurrence limit sets a maximum coverage amount for all vehicles damaged in a single incident. Typically, this limit is around $2,500.

- Per-vehicle deductible is the amount deducted from your claim for each vehicle that is damaged or stolen.

- Direct primary covers a customer’s vehicle for theft or damage, regardless of who is at fault.

- Direct excess works similarly to the direct primary option. However, if the insured isn’t liable, the coverage only pays in excess of any amount collectible under the owner’s standard auto policy.

- Personal property endorsement is an optional protection coverage for personal items inside customers’ vehicles under your care.

3. Workers’ compensation insurance

Auto shop mechanics are exposed to many hazards, from chemical and particle exposure to slips and falls. That’s why workers’ compensation insurance is crucial. It funds medical expenses and lost wages for workers who get injured or sick as a result of performing their jobs.

Ultimately, it ensures injured employees receive the care they need while your shop avoids costly legal disputes or out-of-pocket medical expenses.

Employers pay for workers’ compensation insurance, while employees should be exempt from contributing to the cost of compensation. Employees lose their right to workers’ compensation if their injury resulted solely from the intent to injure themselves or others, as well as drug or alcohol intoxication.

4. Business property insurance

Business or commercial property insurance safeguards your shop’s assets, including buildings, tools, equipment, technology, and inventory. It protects you against damage from fire, theft, vandalism, and certain natural disasters.

Let’s say a fire broke out in your shop and destroyed most of your equipment. This policy will cover the cost of repairs or replacements so you can get back up and running quickly.

5. Errors and omissions (E&O) insurance

Even with the most qualified mechanics on your team, mistakes can happen. Sometimes, they might install the wrong part, use a defective item, or overlook a crucial detail that may compel a customer to sue. That’s where errors and omissions (E&O) insurance comes in.

This policy protects your business against claims resulting from mistakes, negligence, or faulty quality. It lets you cover legal fees and settlements if a customer accuses your shop of poor service.

6. Business income insurance

Also known as business interruption insurance, this policy allows you to recover lost income and operating expenses if your shop closes temporarily because of risks like a fire or severe storm. It can also help pay for moving costs if you need to relocate while your shop undergoes repair.

For instance, if a fire damaged your shop and you needed to shut down for a few weeks to fix things, this insurance could cover the money you’d normally make. It can pay some of your bills and keep your business going during the closure.

How to Choose an Auto Repair Business Insurance Provider

The first insurance provider you see isn’t always the right one. Here’s a simple guide to help you make the best choice.

Assess your risks

Equipment damage, employee injuries, and customer vehicle damage are common risks in an auto repair shop. Start by assessing them and how they relate to the services you provide, the number of employees you have, and the value of the equipment and vehicles in your shop. This evaluation can help you figure out which types of insurance you need.

Then, think about the size of your business. You may need higher coverage if you run a big shop, have a sizeable workforce and pricey equipment, and serve many vehicles. Meanwhile, you may need less if you have smaller operations.

It’s worth choosing an insurance provider that lets you customize your coverage to fit your shop’s specific needs and risks.

Get quotes and compare prices and coverage

Price matters, but it’s not the only thing to consider when choosing an insurance policy. Request quotes from multiple providers to understand the price range based on your shop’s size, location, and needs.

If the rates seem high, you can lower the risks in your shop—like installing safety equipment or adjusting deductibles to reduce costs—while still getting the protection your business needs.

Review your policy annually

As time passes, new car repair tools will emerge and your business will change to meet customer demands. That’s why it’s essential to review your insurance annually and see if it matches what you currently or might need.

If you expand your shop or buy new equipment, check with your provider about how that affects your coverage.

Reviewing your policy is also a great time to think about what would happen if you could no longer run the business. Plus, you can cut any coverage you no longer need so you can have more funds for other insurance options or business investments.

Your Business Deserves the Best Protection

Choosing the right insurance for your auto repair shop is vital in protecting your business from property damage, liability claims, employee injuries, and other risks. Take note of the options and tips above to know what auto repair shop insurance type you should get.

At HG AutoTech, we understand the unique challenges auto repair businesses face. Our automotive software solutions optimize various aspects of your daily operations to lower your business risks.

Contact us today to learn more about our automotive consulting services.